Primaries concluded, stage set for electioneering

In our previous report “Navigating the Tide”, we highlighted that the 2019 general elections look set to be one of the most tightly contested since the return to democratic governance, especially as the opposing People’s Democratic Party (PDP) seeks to return to power after being defeated in the last general elections by the All Progressive Congress (APC). Recent political activities have culminated in the key parties adopting their candidates for the upcoming presidential elections. In this report, we provide an update on recent developments and reiterate our expectations.

Buhari and Atiku lead quest for the reins

President Muhammadu Buhari emerged as the flagbearer for the All Progressive Congress (APC) for the upcoming elections during the recent party conventions—a mere formality as President Buhari is the sole candidate for the party. In contrast, the People’s Democratic Party (PDP) had to endure a more rocky ride. Over 11 candidates participated in the party primaries, each pulling varying degree of political weight. However, it was former vice president Atiku Abubakar who prevailed, leaving notable names such as Aminu Tambuwal (current governor of Sokoto state), Bukola Saraki (current Senate president), Rabiu Kwankwanso (former governor of Kano state), amongst others, in his trail.

Fringe players unlikely to stir the waters

Other than the PDP and APC, there were other parties who also adopted their presidential candidates among whom are Obiageli Ezekwesili (Allied Congress Party of Nigeria – ACPN), Kingsley Moghalu (Young Progressive Party – YPP), Donald Duke (Social Democratic Party – SDP), Fela Durotoye (Alliance for New Nigeria – ANN), Omoyele Sowore (African Action Congress – AAC), Tope Fasau (Abundance Nigeria Renewal Party – ANRP) and Eunice Atuejide (National Interest Party – NIP).

In our previous report, we had highlighted the possibility of a coalition or a potential third contender that could rattle the current political power play. However, recent developments do not yet support this possibility. While there may be some reputable names listed above, we do not foresee any fierce challenge coming from any of the candidates, notably due to lack of significant grassroots spread. Instead, our assessment is that the upcoming presidential polls will be a two-horse race between the ruling APC and the opposition PDP, who are both more formidable in platform and geographical spread.

Our expectations have not changed

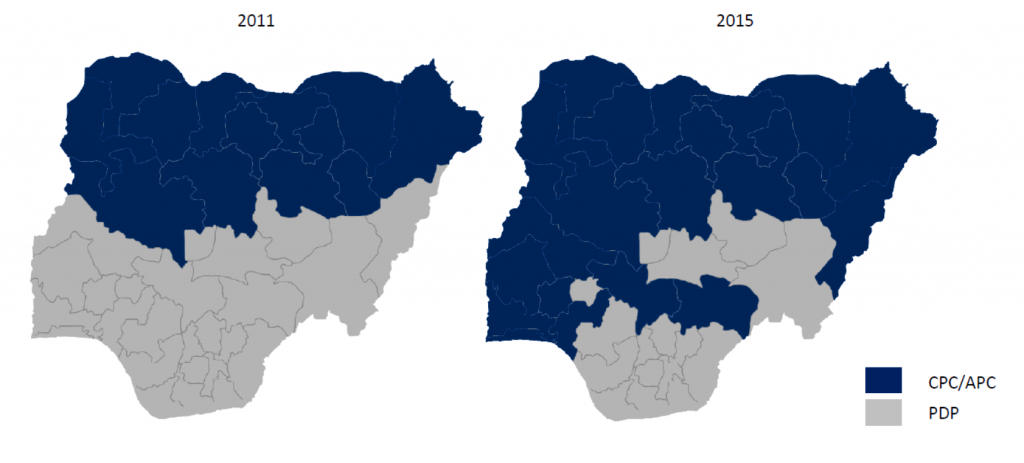

A lot of factors come into play going into the 2019 general elections. The APC is expected to retain most of their territory given their significantly stronger base than the PDP currently. Following the 2015 elections, the APC controls 24 states, while the PDP controls 11 states. Recent elections have also put Ekiti state (formerly under the control of the PDP) in the hands of the APC.

However, there may be a few surprises yet to pan out, notably with respect to the Middlebelt states which swung from the PDP in 2011 to the APC in 2015. We think that these states have the potential to swing either way in the upcoming general elections, given host communities dissatisfaction with the government’s handling of the Fulani herders-farmers clashes.

South East and South South states voted predominantly for the PDP during the last two presidential elections and it is widely expected to remain the same come 2019.

Figure 1: Geographical spread of key political parties

Risks to the incumbent

Notwithstanding our expectations, we believe that there are other key elements that can sway votes towards or away from the incumbent. We rate factors that can win votes for the ruling administration (APC) as positive, while those that can sway votes away as negative:

| Upward review of the minimum wage – We expect that an upward review of minimum wage before the elections will portend favourably for the incumbent. | space | Positive |

| Speedy implementation of capital budget – Despite the late passage of the budget, we expect that a speedy implementation will enhance the confidence of the electorate in the current government. | space | Positive |

| Insecurity – Lingering concerns around Boko-Haram insurgency and the Fulani herders-farmers clashes can potentially weaken confidence in the current administration | space | Negative |

| Contagion impact of EM concerns – Interest rate hikes in the US and concerns around emerging market economies like Argentina and Turkey have accelerated capital outflows from the domestic economy, putting pressure on FX and the reserves. For context, the foreign reserve has lost 8.4% between May and October this year. While the central bank has resolutely defended the naira through a steady supply of FX, we envisage that further pressures could weaken the domestic economy and derail confidence in the current administration. | space | Negative |

Table 1: 2019 polls – Likely outcome

| Geopolitical zone | Likely outcome |

|---|---|

| North East | APC |

| North West | APC |

| North Central | SWING |

| South East | PDP |

| South West | APC |

| South South | PDP |

All in, we assess that a victory for the incumbent in the 2019 elections will be positive for policy continuity, especially with regards to the implementation of the Economic Recovery and Growth Plan (ERGP). We believe that the ERGP is robust in terms of possibilities for sustainable growth and development of the domestic economy and is a key pathway to ensuring stability. Notwithstanding, there are concerns such as the slow pace of infrastructure development and debt sustainability, amongst others. Please click here to access the ERGP document.

On the other hand, a 2019 victory for the opposition party holds positives for the economy, given that Atiku Abubakar elevates restructuring Nigeria as a panacea for accelerated economic growth. The former vice-president favours wealth creation from the federating units, rather than wealth distribution from the federal government. This would ensure true economic independence of states and better social and economic welfare for the masses, amongst others. Please click here to access Atiku Abubakar’s policy document, initially released in 2015 when he contested on the platform of the APC.

Disclosure

Analyst Certification

The research analyst(s) denoted by an “*” on the cover of this report certifies (or, where multiple research analysts are primarily responsible for this report, the research analysts denoted by an “*” on the cover or within the document individually certifies, with respect to each security or issuer that the research analyst(s) cover in this research) that: (1) all of the views expressed in this report accurately articulate the research analyst(s) independent views/opinions, based on public information regarding the companies, securities, industries or markets discussed in this report. (2) The research analyst(s) compensation or remuneration is in no way connected (either directly or indirectly) to the specific recommendations, estimates or opinions expressed in this report.

Analysts’ Compensation: The research analyst(s) responsible for the preparation of this report receive compensation based upon various factors, including the quality and accuracy of research, client feedback, competitive factors, and overall firm revenues, which include revenues from, among other business units, Investment Banking and Asset Management.

Investment Ratings

CardinalStone employs a 3-step rating system for equities under coverage: Buy, Hold, and Sell.

Buy ≥ +15.00% expected share price performance

Hold +0.00% to +14.99% expected share price performance

Sell < 0.00% expected share price performance

A BUY rating is given to equities with strong fundamentals, which have the potential to rise by at least +15.00% between the current price and the analyst’s target price.

A HOLD rating is given to equities with good fundamentals, which have upside potential within a range of +0.00% and +14.99%,

A SELL rating is given to equities that are highly overvalued or with weak fundamentals, where potential returns of less than 0.00% is expected, between the current price and analyst’s target price.

A NEGATIVE WATCH is given to equities whose fundamentals may deteriorate significantly over the next six (6) months, in our view.

CardinalStone Research distribution of ratings/Investment banking relationships as of August 01, 2018

| Rating | Buy | Sell | Hold |

|---|---|---|---|

| % of total recommendations | 76.9% | 7.7% | 15.4% |

| % with investment banking relationships | 0% | 0% | 3.8% |

Valuation and Risks: Please see the most recent company-specific research report for an analysis of valuation methodology and risks on any security recommended herein. You can contact the analyst named on the front of this note for further details.

Frequency of Next Update: An update of our view on the company (ies) would be provided when next there are substantial developments/financial news on the company.

Conflict of Interest: It is the policy of CardinalStone Partners Limited and its subsidiaries and affiliates (individually and collectively referred to as “CardinalStone”) that research analysts may not be involved in activities that suggest that they are representing the interests of Cardinal Stone in a way likely to appear to be inconsistent with providing independent investment research. In addition, research analysts’ reporting lines are structured to avoid any conflict of interests. For example, research analysts are not subject to the supervision or control of anyone in CardinalStone’s Investment Banking or Sales and Trading departments. However, such sales and trading departments may trade, as principal, based on the research analyst’s published research. Therefore, the proprietary interests of those Sales and Trading departments may conflict with your interests.