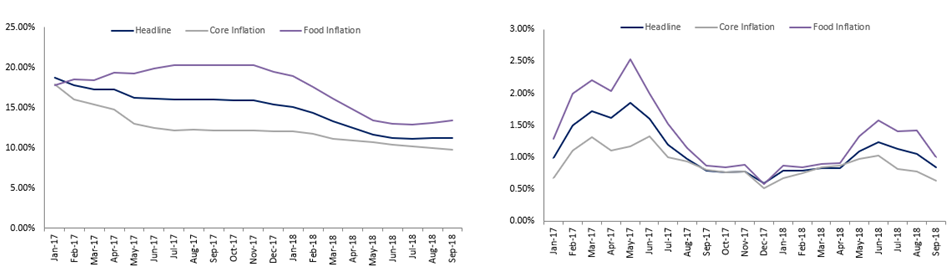

Nigeria’s September 2018 inflation came in 5bps higher at 11.28% YoY compared to 11.23% YoY recorded in August. This increase was lower than our forecast of 11.43% YoY and lower than Bloomberg’s consensus forecasts of 11.50% YoY. The inflation figure marks the second consecutive increase in headline inflation, following an 18-month disinflation trend dating back to January 2017. The uptick in inflation was primarily as a result of rising food prices (food inflation represents 51% of the overall consumer price index). While headline inflation inched higher in September, core inflation dipped to record a 31-month low of 9.84% YoY (August: 10.02% YoY). On a month-on-month basis, headline inflation fell by 21bps to print at 0.84% MoM (August: 1.05% MoM), representing a third consecutive decrease.

Figure 1: YoY Inflation Trend Figure 2: MoM Inflation Trend

Source: NBS

Food inflation slows MoM amid harvests

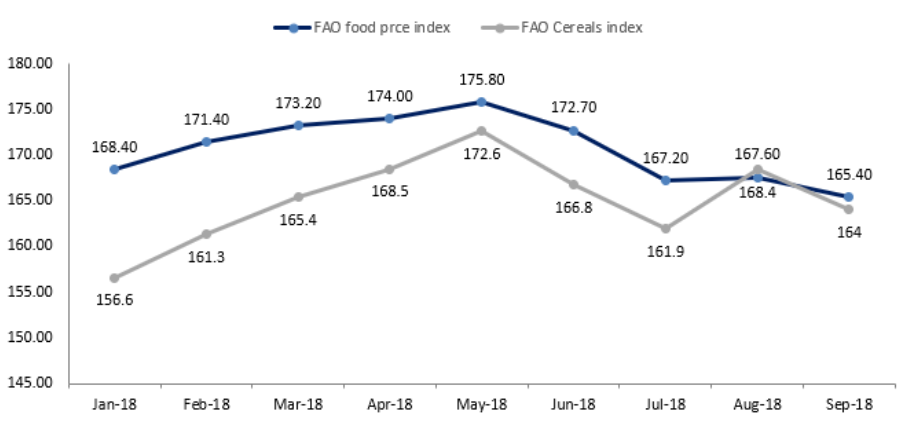

Food inflation declined on a month-on-month basis to record at 1.00% (August: 1.42% MoM). The slowdown in food inflation stemmed from higher than anticipated harvest on September as well as a fall in global food prices. Reports from Famine Emergency Early Warning System Network (FEWS NET) support that harvests of maize, green and yam came to market in September, thus narrowing the supply gap and easing upward pressure on prices. Across the globe, food prices reduced in September, evinced by the fall in the food price index reported by the Food and Agriculture Organization of the United Nations (FAO). The index dipped by 1.37% MoM and 7.40% YoY in September to read at 165.4 points. All sub-indices of the FAO food index, save the sugar index, declined on a month-on-month basis. This was largely due to the decline in the prices of cereals (Nigeria’s largest agricultural import) during the month. As harvest levels appear to be healthy despite the floods experienced in September, we expect a sustained slowdown in food price increases for the remainder of the year. However, this expectation is susceptible to a lagged effect from the flooding in September as well as upward pressure from electioneering activities.

Source: Food and Agricultural Organization of the United Nations

Descent in core inflation to halt in December

Core inflation maintained its downward trend in December declining by 18bps to 9.84% YoY (August: 10.02% YoY). The reduction was mainly driven by the lower inflation in clothing and footwear (declined by 17bps to 10.03% YoY), furnishings and household equipment (declined by 28bps to 9.79% YoY), transport (declined by 15 bps to 10.50% YoY) and miscellaneous goods (declined by 18bps to 9.85% YoY). The reduction in core inflation was recorded despite an uptick recorded in fuels and utility inflation. Notwithstanding, our forecasts indicate that the downward trend in core inflation should bottom out by November at the latest and begin to inch upwards from December as pre-election spending is expected to elevate price levels.

Monetary Policy Impact

Septembers’ inflation figure is expected to impact the decision of the Monetary Policy Committee (MPC) at the upcoming meeting. Policymakers are likely to hold rates constant, given the modest increase in headline inflation (below consensus expectations) alongside the continual decline in core inflation. Stripping out volatile prices (notably food prices), it suffices to mention that general price pressures are waning, evinced by the sustained downward trend in core inflation. This posits a strong argument for Godwin Emefiele and the other six members of the MPC to leave rates unchanged in their next meeting scheduled to hold in November.

Headline inflation to edge higher in coming months

We anticipate higher inflationary pressures through the year as pre-election activities intensify, following the recent conclusion of election primaries. Similarly, the implementation of the 2018 budget is expected to impact on price levels in the quarter. Meanwhile, the Nigeria Labour Congress and the federal government are yet to ink an agreement on a higher minimum wage. If implemented, we expect the impact on general price levels to trickle in after 2018. Nonetheless, Nigeria’s food price outlook looks improved as harvest produce is set to close the supply gap resulting from herdsmen-farmer clashes. Given our improved food price outlook, our October forecast has been revised downwards to 11.35% YoY and our average inflation forecast remains at 12.2% YoY.

Would love to subscribe to your research reports….excellent analysis.

Dear Barbara Barungi,

Thank you for your comment.

You can subscribe to our research reports by clicking this link >>http://bit.ly/CardinalStoneResearchSubscription

Best regards,